-

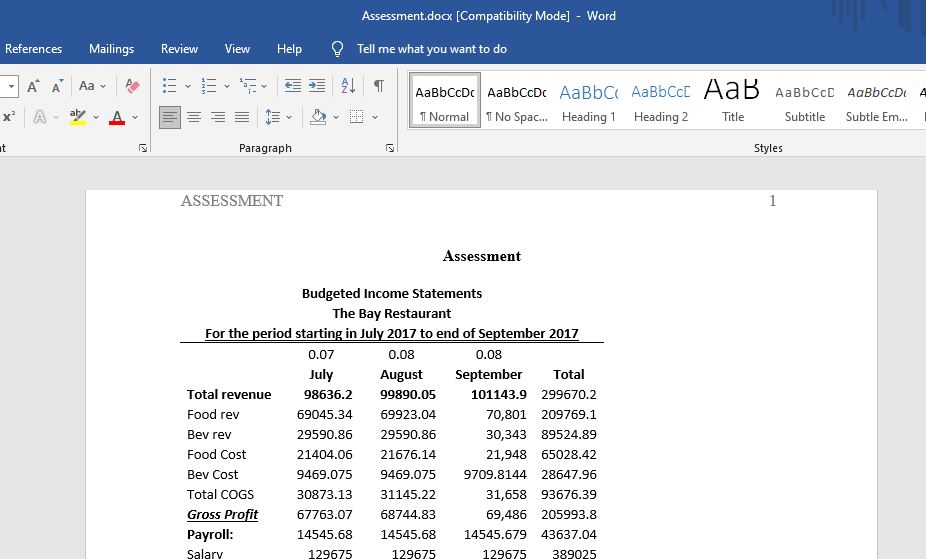

Assessment-Budgeted Income Statements

- Order Summary

- Type of assignment:Assessment

- Academic level:University Level, Bachelor’s

- Referencing style:Harvard

- Number of sources:1

- Subject:Accounting

- Client country:Australia (UK English)

-

Assignment extract:

The detail of the assignment is in the ICHM assessment brief BBHM209 – S2- 2017.pdf (P.11- p.13). All the data that you need is in Information for Assessment 2-209.pdf.

This assignment are required to prepare and present a series of Budgeted Financial Statements, as well as comment on their use in a business environment. (Table of Contents and Conclusion are required )

1. Using the projected business data for The Classic Restaurant, Assistant Managers (the students) are required to prepare a Budget Forecast including Budgeted Income Statement, Cash Budget and Balance Sheet for the quarter ending 30 September 2017.

2. All calculations must be shown through the submission of an Excel file to the Manager (Lecturer). Creation of the budgets using Excel must be completed according to industry standard (e.g. no typed in numbers. Formula must be used in all cells).

3. Assistant Managers are required to present each budget within the report (refer to budgets located in appendices)

4. Provide recommendations to the Manager on:

How the Budgeted Financial Statements for The Classic Restaurant can be used to enhance planning and controls within the business including resource allocation. Four recommendations relevant to the improvement of internal control of the business’s cash receipts and cash payments.

In addition to above exercise:

Explain about the budget cycle, how to prepare the budget in hospitality industry and who is responsible for budget preparation. Describe four ways the non-financial performance of the business can be measured and managed in order to improve business performance.

The Classic Restaurant is a 100 seat establishment in the city of Adelaide. As the new Assistant

Manager of Restaurant, you are required to prepare the forecasted quarterly budgets covering

the 3 months ending 30 September 2017 and submit these to the owner of the company with

recommendations.

Research into revenue and costing forecast has been done and the results collated as follows:

1. Sales at the same period last year were:

Sales 2016

July $ 83,590.00

August $ 97,510.00

September $ 103,600.00

The manager has predicted that due to decreasing interest rates, and review of menu prices

revenue for each month will increase by 1.5%.

2. Business mix is Food 70: 30 Beverage.

3. Cash sales represent 90% of total sales. Debtor receipts are collected in the month following

the sale (30-day account).

4. Food COGS is expected to increasing to 31% of food sales with the new menu due to a focus

on using local produce. Beverage COGS is projected to be 32%.

5. Seventy per cent of all food & beverage purchases are paid for within the month of purchase

(COD) and 30% are paid for in the following month.

6. Depreciation expense for the quarter will be $8,600.

7. Monthly loan payments are $2,000. (Including $550 interest).

8. The Company Tax rate is currently 28.5%, the next payment is due on 28th July 2017.

9. Accrued GST will be payable on 15 of july.

10. Stock on hand (Inventory) as at 30 September 2017 is projected to be the same as the opening

balance for the quarter.

11. Equipment purchases for August 2017 are planned to be $25,600 – to be paid with cash.